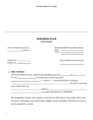

What is a Quitclaim Deed in North Carolina?

A Quitclaim Deed in North Carolina is a quick method of transferring property ownership. It allows the property owner (“Grantor”) to transfer their interests in the property to a new owner (“Grantee”). Quitclaim deeds are a quick way to transfer property, yet, they provide the lowest level of security among real estate deeds in North Carolina.

What is the Difference Between a Quitclaim Deed and a Warranty Deed in North Carolina?

The main difference between a quitclaim deed and a warranty deed lies in the level of protection they offer to the grantee on the property’s title. A quitclaim deed does not provide any promises of protection, making it faster but lacking assurance of a valid title. On the other hand, a warranty deed ensures full protection, guaranteeing the property’s freedom from ownership conflicts but involves a lengthier process to verify compliance with local, state, and federal laws.

How Do Quitclaim Deeds Work in North Carolina?

State law ruling quitclaim deeds can be found in the North Carolina General Statutes, under Chapter 47, Probate and Registration. Quitclaim deeds are one of the ways to communicate the transfer of real property.

The wording in a quitclaim deed must contain specific information, including the terms to which both parties agree. Once the deed is drafted, it must be registered at the Register of Deeds.

Can You Prepare Your Own Quitclaim Deed in North Carolina?

A professional drafter is not legally required in North Carolina. If a drafter does prepare the document, their name and address must be included in the first page of the deed.

North Carolina Quitclaim Deed Requirements

There are multiple requirements for formatting and content that need to be included in a quitclaim deed in North Carolina.

Formatting Requirements

Formatting requirements for quitclaim deeds in North Carolina include:

- Paper size: between 8.5 x 11 to 8.5 x 14.

- Margins: 3″ top margin on the first page; 0.5″ minimum margins on all sides for all pages.

- Ink and paper: Black ink on white paper.

- Font size: Minimum 9 points.

- Forms can be filled in pen; corrections can be made in pen.

- Title “Quitclaim” should be on top of the first page.

- Text should be on one side of each page.

Content Requirements

Content requirements for quitclaim deeds in North Carolina include:

- The drafter’s full name and address must be on the first page.

- Grantor and Grantee’s Names and addresses.

- Address of property.

- Property legal description.

- Parcel Identifier number (PIN).

- Date of transfer.

- The consideration (if any) paid for the property.

- A statement confirming the tax status of the deed, including amounts owed, transfer tax, or exemptions, if any.

- Statement whether the property is or is not the primary residence of the grantor.

Who Signs a Quitclaim Deed in North Carolina?

In North Carolina, quitclaim deeds require a signature from the grantor. The grantor must have their signature authenticated by a notary.

How to File a Quitclaim Deed in North Carolina

Here’s how to file a quitclaim deed in North Carolina:

- Once the quitclaim deed is drafted, the grantor must sign the document, ensuring that their signature is validated by a notary.

- Submit the completed set of documents, along with the applicable fees, at the Register of Deeds in the county where the property is located.

How Much Does it Cost to File a Quitclaim Deed in North Carolina?

The cost of filing a quitclaim deed at the Register of Deeds in North Carolina begins with a $26.00 recording fee for up to 15 pages.

In addition to the recording fee, the total cost will depend on the county where the deed is to be filed. Most counties charge $64 for the first 35 pages plus $4 for each additional page.

What Taxes Are Owed on Quitclaim Deeds in North Carolina?

In North Carolina, any quitclaim deed where there is a sale of the property, a transfer tax (or “exercise tax”) will be levied at a rate of $1 on each $500.

In addition to transfer tax, Camden, Chowan, Currituck, Dare, Pasquotank, Perquimans, and Washington counties are authorized to charge land transfer tax at the rate of $1.00 per $100.00 of the property’s value.

Finally, federal taxes such as Gift Tax and Capital Gains Tax may also be applicable.

How Long Does a Quitclaim Deed Take to be Recorded in North Carolina?

The length of time to record a quitclaim deed in North Carolina ranges between two weeks to three months.

What Happens After a Quitclaim Deed is Recorded in North Carolina?

In North Carolina, once the quitclaim deed is signed and filed, the county will process the document, creating a public record of the transfer of ownership.

If the deed is clear of any previous filings, a public record of the transfer of the property’s ownership will be made official.

How Long Are Quitclaim Deeds Valid For in North Carolina?

There is no expiration for quitclaim deeds in North Carolina. However, the statute of limitations for challenging a deed is 3 years from the date the deed was recorded with the county.

Sources

- 1 North Carolina, G.S. § 47H-2. (a)

-

“Every contract for deed shall be evidenced by a contract signed and acknowledged by all parties to it and containing all the terms to which they have agreed. The seller shall deliver to the purchaser an exact copy of the contract, containing all the disclosures required by subsection (b) of this section, at the time the purchaser signs the contract.”

Source Link - 2 North Carolina G.S. § 47-17.1.

-

Documents registered or ordered to be registered in certain counties to designate draftsman; exceptions.. unless the first page of the deeds or deeds of trust bears an entry showing the name of the drafter of the deed or deed of trust. The register of deeds shall not be required to verify or make inquiry concerning the capacity or authority of the person or entity shown as the drafter on the instrument.

Source Link - 3 North Carolina G.S. § 161-14

-

(b) All instruments, except instruments conforming to the provisions of G.S. 25-9-521, presented for registration on paper shall meet all of the following requirements..

Source Link - 4 North Carolina G.S. § 47H-2.

-

(b) Content. Minimum contents for contracts for deed; recordation. Contents.

Source Link - 5 North Carolina G.S § 161-22.2.

-

Parcel identifier number indexes.(a) In lieu of the alphabetical indexes required by G.S. 161-21, 161-22 and 161-22.1, the register of deeds of any county in which unique parcel identifier numbers have been assigned to all parcels of real property may install an index by land parcel identifier numbers..

Source Link - 6 North Carolina G.S.§ 105-228.32.

-

Instrument must be marked to reflect tax paid: A person who presents an instrument for registration must report to the Register of Deeds the amount of tax due. It is the duty of the person presenting the instrument for registration to report the correct amount of tax due. Before the instrument may be recorded, the Register of Deeds must collect the tax due and mark the instrument to indicate that the tax has been paid and the amount of the tax paid.

North Carolina G.S.§105-228.29.

Source Link

Exemptions. - 7 North Carolina G.S. § 105-317.2

-

Report on transfers of real property.

To facilitate the accurate appraisal of real property for taxation.. 2) A statement whether the property includes the primary residence of a grantor.

Source Link - 8 North Carolina Statutes § 47-38.

-

Acknowledgment by grantor. When properly completed, a certificate in substantially the following form may be used and shall be sufficient under the law of this State to satisfy the requirements for a notarial certificate for one or more individuals, acting in his, her, or their own right or, whether or not so stated in the notarial certificate…

Source Link - 9 North Carolina Statutes § 161-10

-

Uniform fees of registers of deeds.or registering or filing any instrument for which no other provision is made by this section, the fee shall be twenty-six dollars ($26.00) for the first 15 pages plus four dollars ($4.00) for each additional page or fraction thereof.

Source Link - 10 North Carolina Statutes Article 8E.

-

Excise Tax on Conveyances. 105-228.30. Imposition of excise tax; distribution of proceeds. (a) An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The tax rate is one dollar ($1.00) on each five hundred dollars ($500.00) or fractional part thereof of the consideration or value of the interest conveyed.

Source Link - 11 Land Transfer Tax

-

“..seven counties – Dare, Camden, Chowan, Currituck, Pasquotank, Perquimans, and Washington – are authorized to levy a local real estate transfer tax of $1 per $100 of the full consideration including the value of any lien on the property at the time of sale.”

Source Link - 12 North Carolina Statues § 161-31

-

Tax Certification. (a) The board of commissioners of a county may, by resolution, require the register of deeds not to accept any deed transferring real property for registration unless the county tax collector has certified that no delinquent ad valorem county taxes, ad valorem municipal taxes, or other taxes with which the collector is charged are a lien on the property described in the deed..

Source Link - 13 North Carolina Statutes § 1-52.

-

Upon a contract, obligation or liability arising out of a contract, express or implied, except those mentioned in the preceding sections or in G.S. 1-53(1)

Source Link