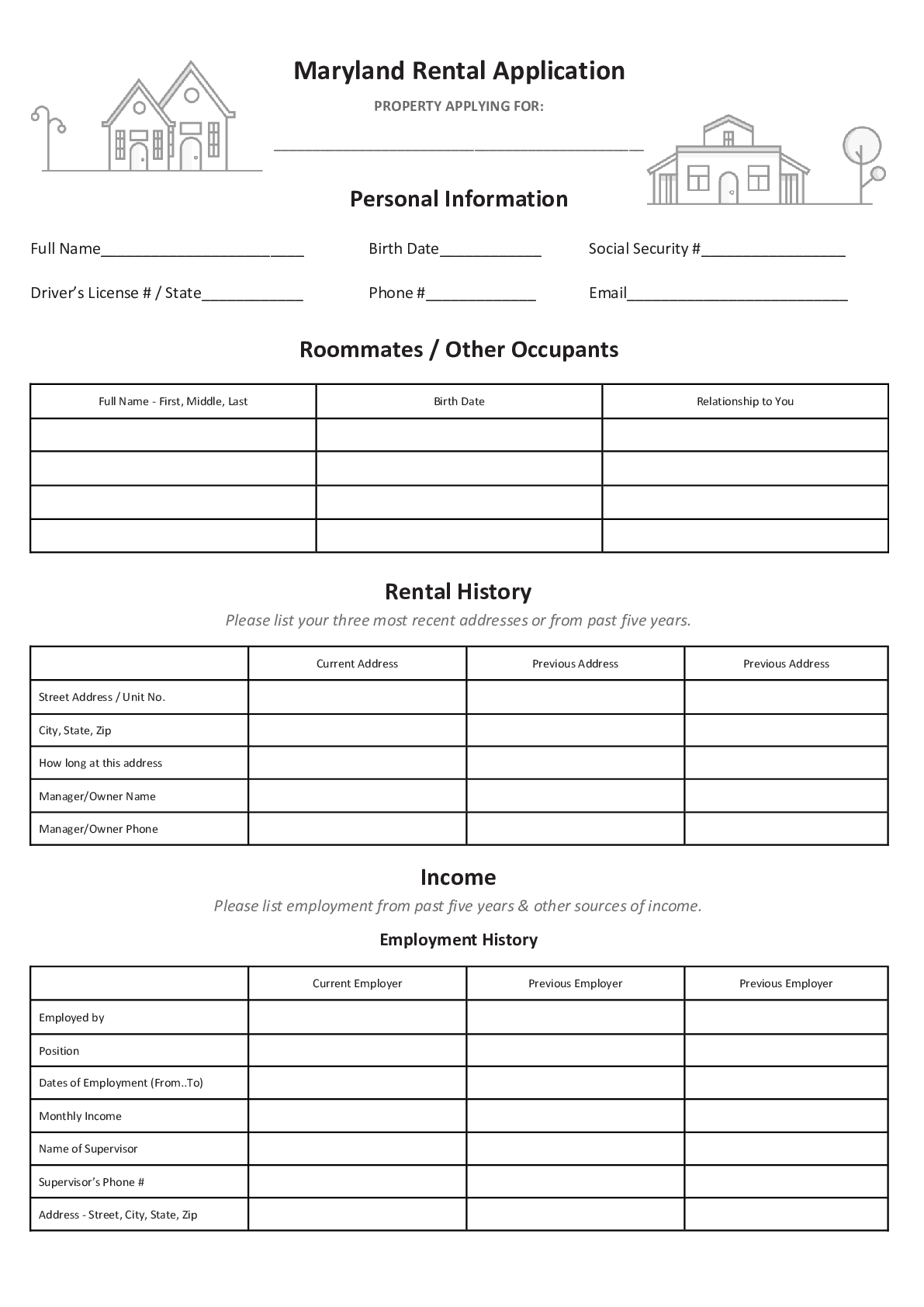

A Maryland rental agreement is a legal contract between a landlord overseeing a rental property and a tenant using the property. Maryland landlord-tenant law governs and regulates these agreements.

Maryland Rental Agreement Types

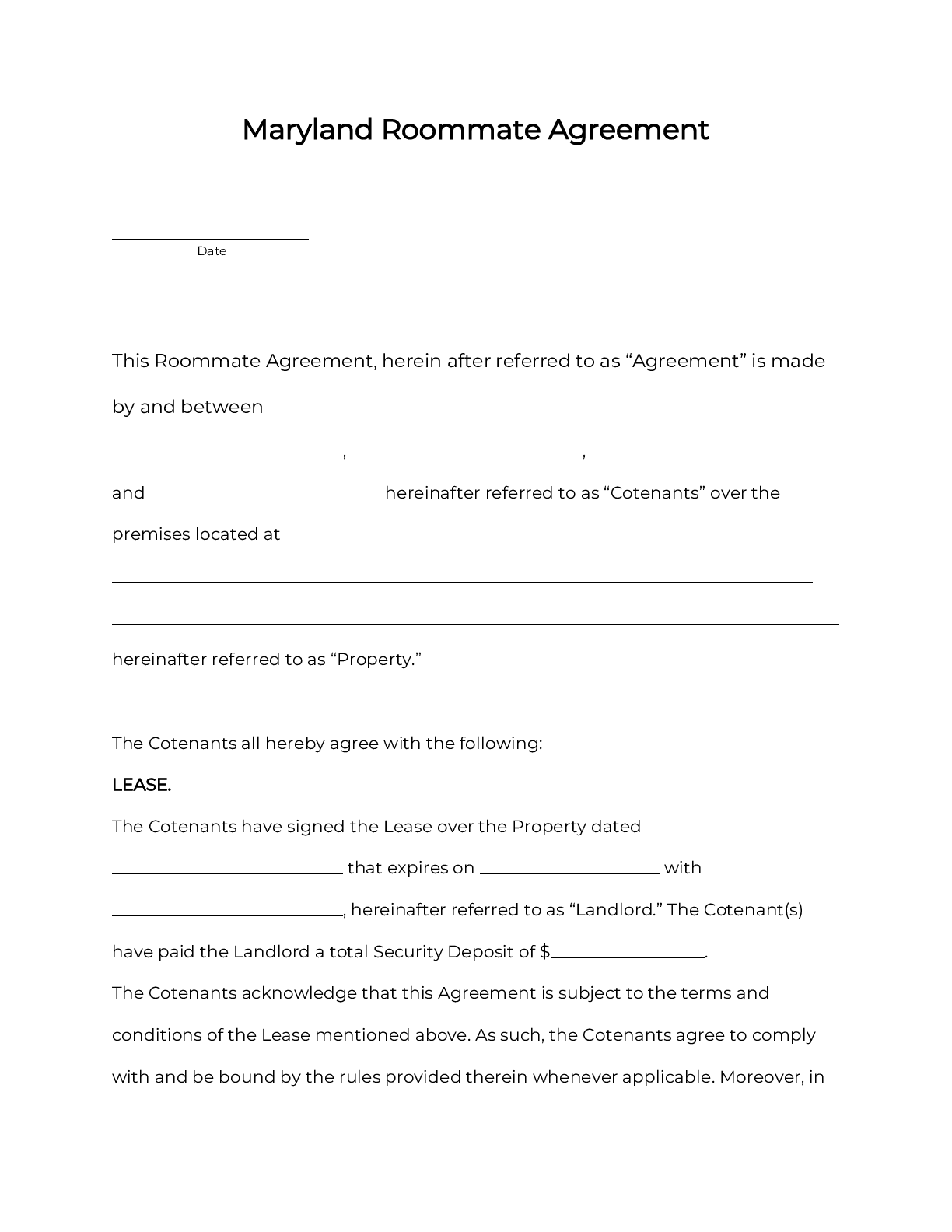

A Maryland roommate agreement is a legal contract between two or more people (“co-tenants”) who share a rental property according to rules they set, including for things like splitting the rent. This agreement binds the co-tenants living together, and doesn’t include the landlord.

Common Residential Rental Agreements in Maryland

- Montgomery County’s Housing of Community Affairs (DHCA) Single Family Dwelling Lease – This lease is in common use throughout Montgomery County. The template cannot be used in Gaithersburg, Rockville, or Takoma Park. It covers an extensive list of rules and procedures, including the local requirement for landlords to offer an initial lease term of 2 years. Note that the initial lease must be accompanied by a DHCA Lease Summary.

- Montgomery County’s Housing of Community Affairs (DHCA) Room Rental Dwelling Lease – This easy-to-read roommate agreement is for residential room rentals in Montgomery County. It outlines how much the roommate is expected to pay for a security deposit, rent, utilities, and any additional charges.

Maryland Required Residential Lease Disclosures

- Landlord’s Name and Address (required for all leases) – Maryland leases must contain the landlord’s name and address, or that of their authorized agent. This allows required communication (for example, about repairs) to happen in a smooth way. Typically includes additional contact information, such as phone numbers and email addresses.

- Security Deposit Receipt (required for some leases) – Maryland landlords collecting a security deposit must provide a receipt upon collection. The receipt must note the following:

- The tenant’s right right to complete a move-in and move-out checklist within 15 days of the lease beginning

- The tenant’s right to an inspection making itemized deductions from the security deposit

- Disclosure that landlord failure to obey the security deposit statute makes the landlord liable triple the total deposit as damages to the tenant

- Water and Sewage Utility Obligation Disclosure (required for some leases) – Maryland leases for 1- or 2-unit buildings that share utilities must provide a disclosure which also mentions the tenant’s right to receive copies of utility bills.

- Ratio Utility Billing System (RUBS) Disclosure (required for some leases) – Maryland leases must disclose in writing if they use a ratio utility billing system (RUBS).

- Statement of Habitation Disclosure (required for all leases) – Maryland leases must certify the property’s condition and agree with the tenant on who is responsible to fix which issues with the property.

- Lead Based Paint Disclosure (required for some leases) – Landlords must provide an EPA-approved disclosure and informational pamphlet to tenants renting any property built before 1978.

To learn more about required disclosures in Maryland, click here.

Maryland Landlord Tenant Laws

- Warranty of Habitability – Maryland landlords can only rent out habitable property. This means providing certain basic health and safety features like heat, plumbing, and electricity. Landlords must repair any issues within a reasonable time (up to 30 days) after proper notice. Failure to repair lets a tenant sue the landlord, end the lease, or withhold rent into an approved escrow. Tenants in Maryland can’t repair and deduct.

- Evictions – Maryland landlords may evict for rent nonpayment, lease violations, or illegal acts, among other things. Before filing eviction, landlords must serve tenants with prior notice to pay, comply or quit, depending on the eviction type. This means most evictions in Maryland take between two weeks to a few months.

- Security Deposits – Maryland limits security deposits to twice the periodic rent. When a lease ends, the landlord must return any unused portion of a tenant’s deposit within 45 days.

- Lease Termination – Maryland tenants can end a month-to-month lease with one month of advance notice. Terminating a fixed-term lease usually requires active military duty, landlord harassment, uninhabitable property, or domestic abuse.

- Rent Increases and Fees – Maryland has no statewide rent control policy, but local areas can set their own rent increase rules. Late fees cannot exceed 5% of the periodic rent, or if paid on a weekly basis, no more than $3/week or $12/month. Returned check fees have a $35 cap.

- Landlord Entry – Maryland landlords may enter rental property for reasonable business purposes like maintenance, inspections, and property showings. They must enter at reasonable times of day using reasonable advance notice (customarily at least 24 hours). Emergency situations are exempt from these rules.

- Settling Legal Disputes – Maryland lets small claims courts hear landlord-tenant disputes, as long as the amount in controversy is under $5,000. Unlike many states, Maryland’s small claims courts can hear eviction cases.

To learn more about landlord tenant laws in Maryland, click here.

Sources

- 1 Md. Code, Com. § 15-802(b), (c)(1)(i), & (e)(1)(b)

-

If a check or other instrument has not been paid within 30 days after the holder has sent a notice of dishonor to the maker or drawer, the maker or drawer of a check or other instrument that has been dishonored shall be liable for:

(1) The amount of the check or instrument;

(2) A collection fee of up to $35; and

(3) An amount up to 2 times the amount of the check, but not more than $1,000.

(c) (1) (i) The holder of a check or other instrument that has been dishonored may seek the damages provided under this section in the District Court of Maryland 30 days after a notice of dishonor has been sent by mail to the last known address of the maker or drawer.

…

(e) (1) It shall be a complete defense to any action brought under this section by any holder of a dishonored check or other instrument that, within 30 days from the mailing of the notice of dishonor, the maker or drawer has paid to the holder the full amount of the check or other instrument and collection costs of not more than $35.

Source Link